In chaos theory, the butterfly effect shows us how small events can create large unexpected changes later. The name comes from the idea that something as small as the flap of a butterfly’s wings could lead to a hurricane on the other side of the world.

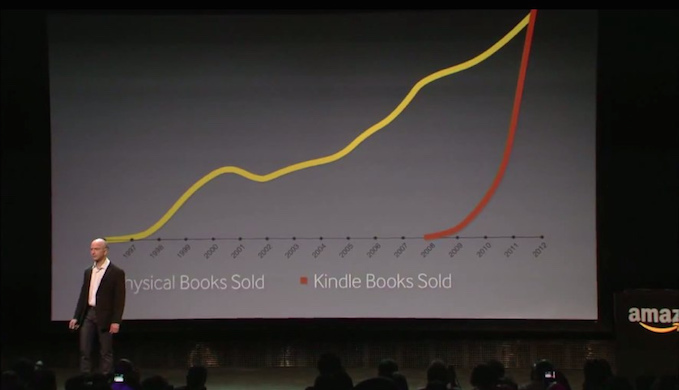

Entrepreneurs, engineers, and tech junkies dream about the change they might create within a given system. Direct changes might include making books available for the first time online (i.e. Amazon), democratizing investing by lowering minimums and fees, or enabling friends to split the check at dinner without any cash exchanging hands.

The larger question is, what nonlinear butterfly effect does each of these technological innovations have? By making books available online did Jeff Bezos merely enable us to receive hard copies in the mail? Or did Amazon begin other ripple effects, such as the creation of the modern financial system?

Innovation = Change in Cost / Value

It seems clear in hindsight that Bezos made large strides for all future e-commerce sites in helping individuals feel comfortable with making purchases online, while changing the lifestyle of an entire generation once shackled to cars and brick-and-mortar retail.

These direct effects are easy to trace. The indirect ripple effects might not be so easy.

Trailblazers, and those around them, often cannot foresee the subsequent, nonlinear effects of certain actions. Is it possible that the ability to feel comfortable transacting online might lead to secular changes in interest rates forever and a complete overhaul of the financial system as we know it?

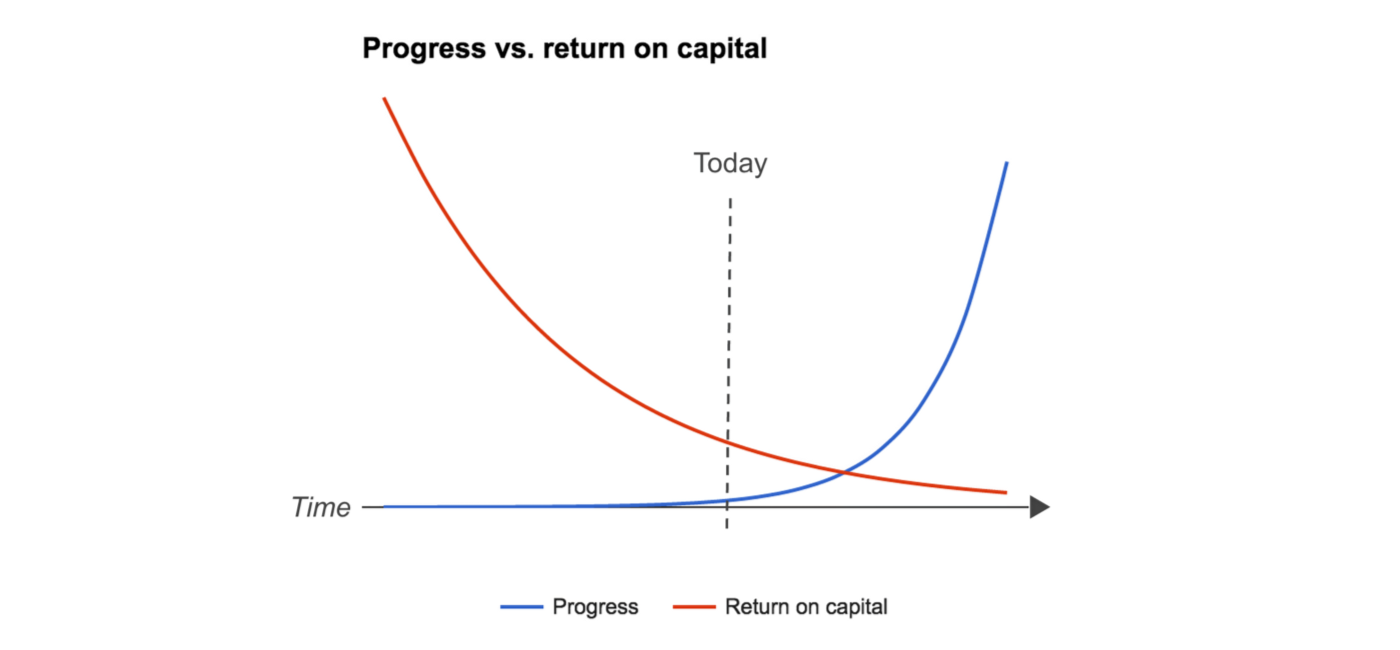

Paul Gebhart thinks so. His recent piece on “The End of Interest Rates” runs counter to the more popular narrative today that capital is seeing increasingly stronger returns as technology reduces headcount and labor costs.

Gebhart argues that return on capital will take a secular plunge to zero (and stay there) due to the persistence of technological disruption by online financial technology companies. This convergence to zero, Gebhart writes, will be the result of an abundance of capital enabled by technological progress.

As technology reduces the cost to start a business, excess capital is freed up to be deployed elsewhere.

Moreover, with technological innovation comes more efficient means of investing which lowers overhead costs and thus fees. With a disproportionate amount of capital chasing a finite number of passive investments, rates of return will shrink.

One could argue that this is already being demonstrated in today’s low interest rate environment. While it was common to earn in the high teens up to twenty-something percent in the 1980s, the past several years have shown investors struggling to earn even mid-single digit returns.

If the prevailing narratives are right, it certainly hasn’t yet been demonstrated for passive investors on a broad scale.

If Gebhart is onto something, will it mean the end of passive income. And, can we blame Bezos?

If it is the beginning of zero returns, that could certainly mean chaos.

Top Image Source: Wesley Fryer, Flickr

Progress vs. Return on Capital image source: Paul Gebhardt, Medium

Source: Kendall Davis Fundrise.com